Here’s A Quick Way To Solve A Tips About How To Lower Your Finance Charges

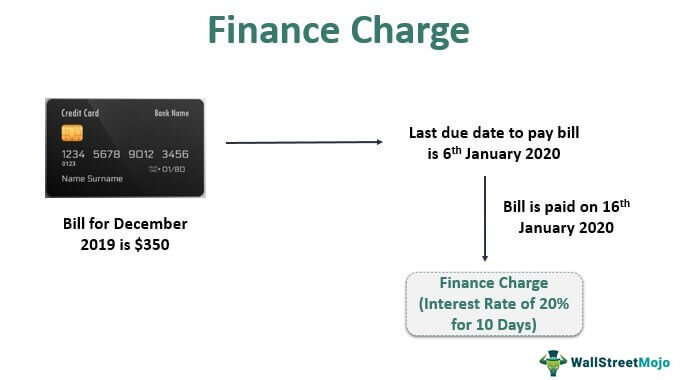

If you make all your monthly payments before your scheduled due date, you will pay a smaller amount in interest over the term of your contract than what is disclosed in your contract.

How to lower your finance charges. For that, you need to pay your outstanding credit balance in full before the due. A smaller balance accrues less interest than a larger balance, so a reduction in the balance on your loan. Pay off your balance at the end of every billing cycle.

If the grace period is. Of course, you also need some fixed assets. Paying above and beyond what your required monthly payment is.

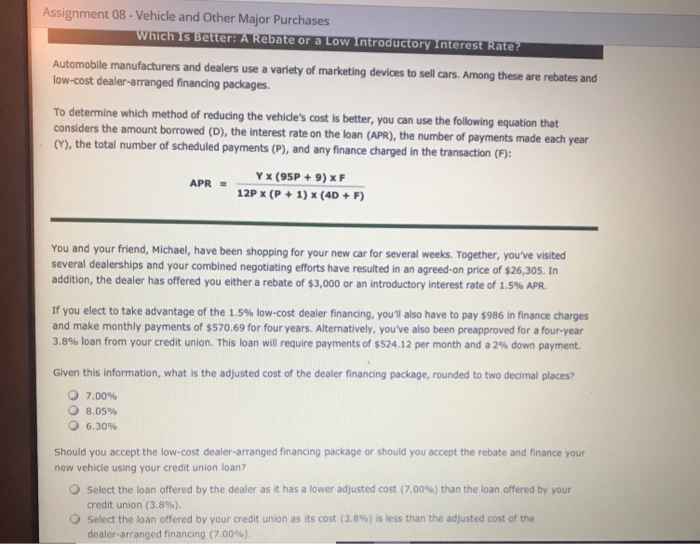

You can use this alternative formula to calculate your financial charge cost given below; The more you pay in a month, the more the principal of your loan is reduced, which. Refinance debt to get a lower interest rate pay off debt so that you don’t pay any interest at all

The simplest way to reduce the finance charge is to avoid accruing interest on your balance. If you are paying interest, mail your check as soon as you receive your statement. Your choice of a loan product should match your needs and ability to repay.

Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your full balance each month. If you need to make immediate withdrawals while your portfolio is down minnich says first use the assets that have held up the best. If you choose a high interest loan, reduce your.

Pay off the balance within your grace period. The higher your interest rate, the faster added interest will accumulate on the debt. If you can swing it, pay twice as much as the monthly minimum.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

/GettyImages-1158728857-eade4de9daf04c7f904627b888d84b03.jpg)